Introduction

Ethereum might have solved its energy problem with The Merge. But in doing so, it has reframed scalability as a top challenge in blockchain today. This has prompted Layer 2 solutions like Optimism and Arbitrum (among many others) to step in to aid Ethereum's scalability journey.

However, while L2s are essential for faster onchain interactions, understanding their differences is crucial.

For DeFi users and developers, choosing the right L2 can mean lower costs, better performance, and access to new and lucrative opportunities. In this guide, we’ll break down the key differences between Optimism and Arbitrum so you can decide which one fits your needs.

Optimism vs. Arbitrum: At a Glance

Both Optimism (sometimes referred to as “OP”) and Arbitrum are Ethereum Layer 2s. While “Layer 2” might be a buzzword, understanding what it means in practical terms is essential.

Simply put, Layer 2 solutions are protocols built on top of a blockchain—in this case, Ethereum—that help scale the network. By processing transactions off the Ethereum mainnet, L2s reduce congestion, lower gas fees, and enhance transaction speed, making Ethereum more efficient and accessible for users and developers.

This allows Ethereum to handle more transactions per second (TPS) and create a more fluid user experience, especially during periods of high demand. While Optimism and Arbitrum are designed to expand Ethereum’s capabilities, they each operate in distinct ways, offering different trade-offs in performance, cost, and ecosystem integration.

These insights can help DeFi participants minimize costs, optimize transaction efficiency, and strategically position themselves within the evolving crypto space.

Optimism | Arbitrum |

- Est. 2019, mainnet launch in 2021. - Scalability via Optimistic Rollups + single-round fault-proof system. - Uses the Optimistic Virtual Machine (OVM) for Ethereum compatibility. - Superchain-focused, aimed at interconnecting the L2 ecosystem | - Est. 2021, mainnet launch in 2021. - Scalability via Optimistic Rollups + interactive fraud-proof system. - Uses the Arbitrum Virtual Machine (AVM) for Ethereum compatibility. - DeFi-focused, with dApps like Uniswap and Synthetix using the network to scale. |

At the time of writing, Arbitrum leads with a Total Value Locked (TVL) of slightly over $2.4 billion, while Optimism holds around $430 million. Arbitrum has processed over 1.5 billion transactions, reflecting its significant adoption, while Optimism, on the other hand, only recently surpassed the 550 million mark. While both platforms utilize Optimistic Rollups, they each offer distinct features catering to various needs within the Ethereum ecosystem.

Technical Comparison

Topline metrics aside, things start to truly look even more different between these two Layer 2 solutions when we dive into the tech stack. Both Optimism and Arbitrum promise lower fees and faster transactions in a similar fashion. To understand their true differences, let's dive into the underlying technology.

Architecture & Network Performance

Optimism is designed with a strong focus on Ethereum compatibility. It uses Optimistic Rollups, where transactions are assumed valid by default and only checked in case of disputes. The OVM allows developers to deploy Ethereum contracts on Optimism with minimal modifications.

Arbitrum also uses optimistic rollups, using its AVM to process Ethereum contracts with similar efficiently. Arbitrum differs slightly in its use of multi-round interactive fraud-proofs, which minimizes dispute costs compared to OP (more on this in the next section).

Security Models

While both Optimism and Arbitrum leverage Ethereum’s security, each approaches transaction validity differently.

Optimism uses a single-round fault-proof system, where transactions are assumed valid unless challenged. If a dispute arises, the system escalates the transaction directly to Ethereum’s Layer 1 for verification, incurring higher mainnet gas fees. This approach allows faster finality for most transactions, but in cases of disputes, resolution can be more costly.

Arbitrum, by contrast, employs a multi-round interactive fraud-proof system. Rather than immediately escalating disputes to Ethereum, it processes them through incremental verification steps, ensuring that only the disputed portion of a transaction is ultimately submitted to the mainnet. While this approach extends dispute resolution times, it optimizes costs by reducing the need for full transaction re-execution on Ethereum.

User Experience

From our technical comparison, it’s clear that both Optimism and Arbitrum aim to scale Ethereum’s transaction capacity. While both operate under a similar model (though with distinct technological approaches), their differences are most noticeable at the user level.

Costs & Fees

Gas fees on Optimism in 2024 averaged ~0.116 Gwei. While Optimism processes transactions quickly, again, rollup disputes require entire fraud proofs to be settled directly on the Ethereum L1, leading to higher costs due to mainnet gas fees.

Gas fees on Arbitrum in 2024 averaged ~0.051 Gwei. Arbitrum’s multi-round fraud-proof can be attributed to reducing costs and maintaining gas efficiency over time.

For most users, Arbitrum’s lower fees make it a preferred choice for minimizing fluctuating costs, while Optimism offers faster confirmations at the trade-off of slightly higher fees in dispute scenarios.

A note here: both Optimism and Arbitrum are fully compatible with popular Ethereum wallets like MetaMask, making it easy for users to interact with Ethereum-based dApps and move assets across these L2s.

User Interface

Optimism has a simpler UI that aligns closely with Ethereum-native applications. It’s more focused on Ethereum-first integrations, making it a great choice for users looking for straightforward Ethereum interoperability.

Network Stability

While Optimism offers strong network stability, it can experience occasional delays in transaction finality due to its fraud-proof system, especially during peak congestion. Transactions typically reach hard finality within 13 minutes, as they rely on Ethereum’s finalization process.

Arbitrum ensures greater network stability even during high congestion periods. Its hard finality process generally also takes around 13 minutes (similarly relying on Ethereum’s finalization).

Developer Experience

Unsurprisingly, because Optimism and Arbitrum are both designed to scale Ethereum, they offer robust experiences for developers. These experiences differ slightly in terms of ecosystem adoption, tooling, and integrations.

Ecosystem Stats

Optimism | Arbitrum |

- TVL: ~$430 million - Average transaction speed: ~10.73 TPS - Unique addresses: ~200 million | - TVL: ~$2.4 billion - Average transaction speed: ~20.60 TPS - Unique addresses: ~58 million |

While Arbitrum’s larger TVL and deeper DeFi integrations make it the more dominant L2 for financial applications, OP’s governance focus and Superchain vision have led to strong adoption among protocol developers (like Coinbase’s Base).

Developer Tools and Support

Optimism provides solid developer support thanks to its strong Ethereum compatibility. Its close alignment with Ethereum's infrastructure makes it easy for Ethereum-first projects to deploy, but in some cases, may lack the flexibility needed for more scalable, high-performance applications.

Arbitrum offers a broader suite of developer tools, including robust integrations and comprehensive documentation. Its Arbitrum SDK and strong ecosystem support make it an attractive choice for developers looking to migrate complex dApps onto Layer 2.

Optimism vs. Arbitrum: Use Cases

Now that we’ve addressed the pros and cons of Optimism and Arbitrum for both users and developers, it’s time to dive into the actual use cases driving these L2 ecosystems. When selecting between the two, it's essential to consider the specific requirements of your needs or, for developers, the needs of your project.

For DeFi

If you couldn't tell by now, Arbitrum has established itself as a force in the DeFi sector. Boasting a ~460% higher TVL than Optimism (at the time of writing), Arbitrum’s extensive liquidity makes it a solid choice for traders seeking efficient transaction execution. Here are a few platforms to look into on both Optimism vs. Arbitrum.

Optimism: Synthetix, a derivatives liquidity protocol, operates on Optimism, which benefits from lower fees and Ethereum compatibility.

Arbitrum: GMX, a decentralized perpetual exchange, leverages Arbitrum's scalability to offer users efficient trading experiences.

For NFTs

Both Optimism and Arbitrum have been hard at work expanding their NFT ecosystems to offer users cost-effective alternatives to Ethereum's mainnet.

Optimism: Projects like Niftykit are emerging on Optimism, providing platforms to mint, manage, and sell NFTs with reduced fees.

Arbitrum: Shift aggregates listings across all the top Arbitrum NFT marketplaces to grow Arbitrum’s NFT presence.

For Gaming

In the gaming sector, where high transaction throughput and low latency are crucial, Arbitrum's infrastructure offers a tangible advantage over Optimism. However, both networks offer distinct advantages for different gaming projects.

Optimism: Dope Wars, a community-driven gaming project inspired by hip-hop culture, operates on Optimism, leveraging its Ethereum compatibility for game development.

Arbitrum: Treasure, developers of Knights of the Ether and other titles, utilizes Arbitrum to support its gaming ecosystem, benefiting from the network's scalability.

For Building

For developers, choosing between Optimism and Arbitrum involves weighing factors such as tool compatibility, customization options, and community support.

Optimism: Offers a development environment closely aligned with Ethereum's architecture, facilitating straightforward deployment of existing Ethereum-based applications.

Arbitrum: Provides a flexible development framework, supporting a range of programming languages and offering tools for customized application development.

For projects seeking seamless integration with Ethereum, Optimism is advantageous, while Arbitrum caters to developers desiring greater flexibility and customization.

Asset Interoperability

Of course, to even access the OP and Arbitrum ecosystems, you first have to bridge over to them. And as the Ethereum L2 paradigm grows, it’s becoming increasingly important for users to be able to move assets between networks. However, bridging isn’t always straightforward. Factors like speed, cost, security, and compatibility all come into play.

Bridging Options

Users often have two primary ways to move assets between Optimism, Arbitrum, and many of the other L2s out there.

The first is via native bridges:

Brid.gg and Superbridge power the OP ecosystem, while the Arbitrum Bridge powers, well, Arbitrum. Each allows direct asset transfers between Ethereum and their respective L2s.

These solutions inherit Ethereum’s security, but withdrawals can sometimes add a significant amount of time to the fraud-proof challenge period on optimistic rollups.

Additionally, there are third-party bridges:

Protocols like Across offer faster withdrawals by using liquidity pools to facilitate instant swaps.

These services often offer cheaper fees and greater flexibility, allowing users to connect to multiple L2s and even alternative ecosystems.

Across, in particular, enables seamless crosschain interoperability, making it an ideal solution for users looking to bridge between Optimism and Arbitrum with greater efficiency.

While there are various bridging options available on both Optimism and Arbitrum, it’s important to remember that bridging costs vary depending on network congestion, bridge design, and transaction size.

Security Best Practices

With bridges being one of the most targeted attack vectors in crypto, users should always take precautions when moving assets. This is true of interacting with any L2, including Optimism and Arbitrum. When considering bridging, be sure to:

Prioritize well-audited bridges with strong security track records (e.g., Across, with its robust security and a history of zero security incidents).

Verify contract interactions before approving any transactions to prevent malicious approvals.

Monitor transaction confirmations to ensure assets arrive safely on the destination chain.

Enhanced Bridging with Across

By choosing the right bridge and following security best practices, users can confidently move assets between OP and Arbitrum while minimizing costs and risks. Across offers a fast, cost-effective, and secure way to bridge between these L2s, ensuring users can access the best opportunities across chains.

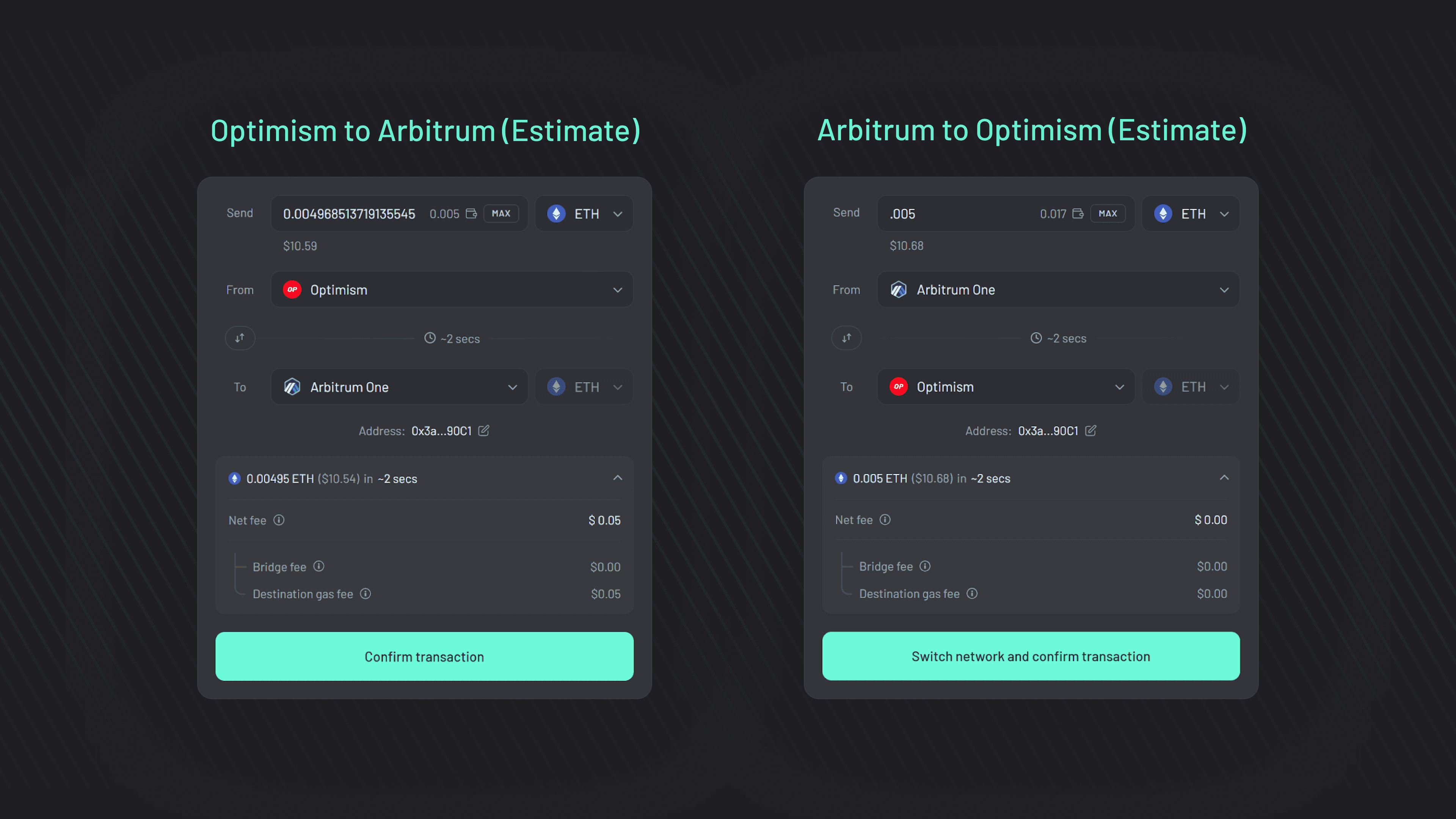

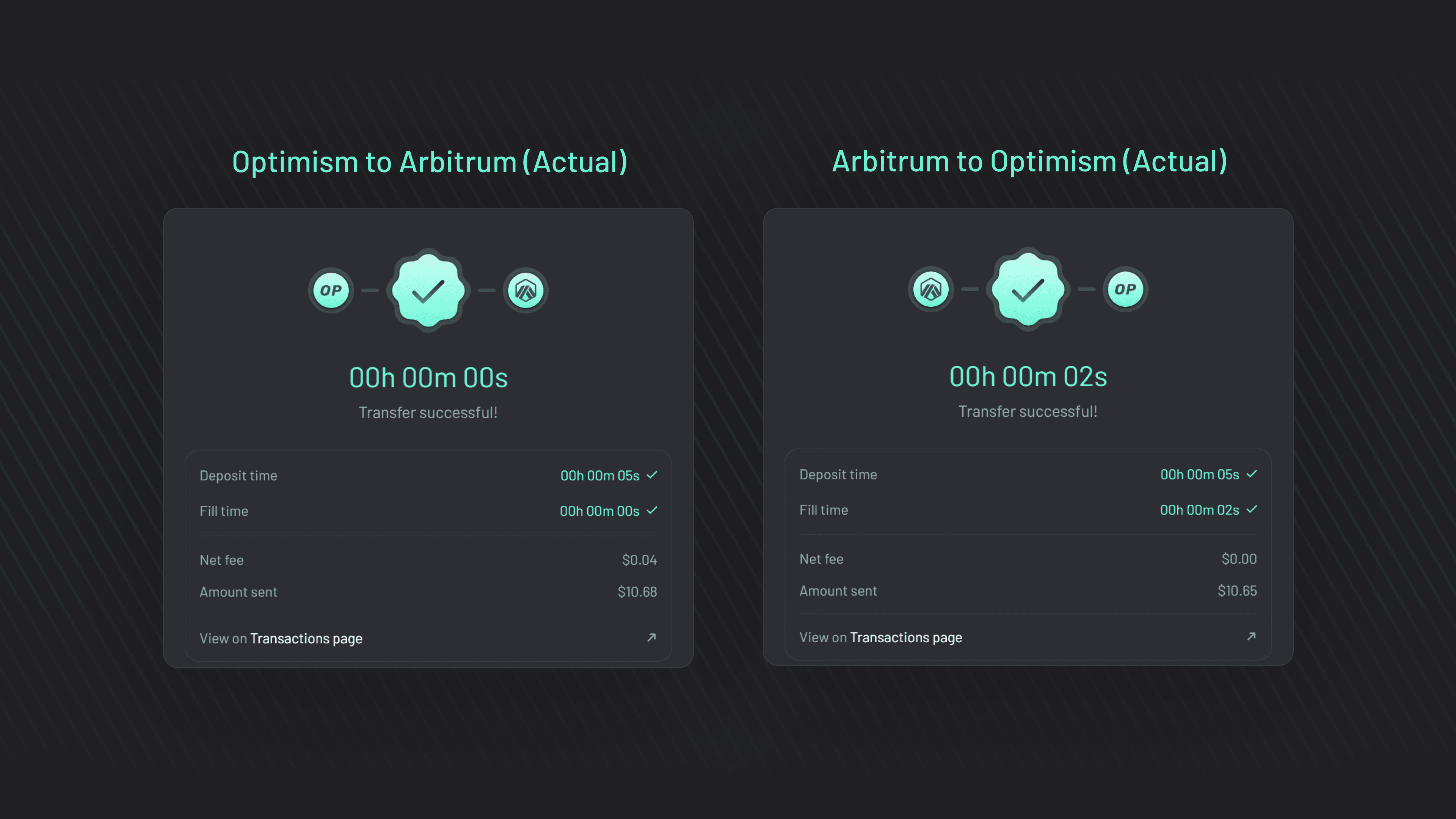

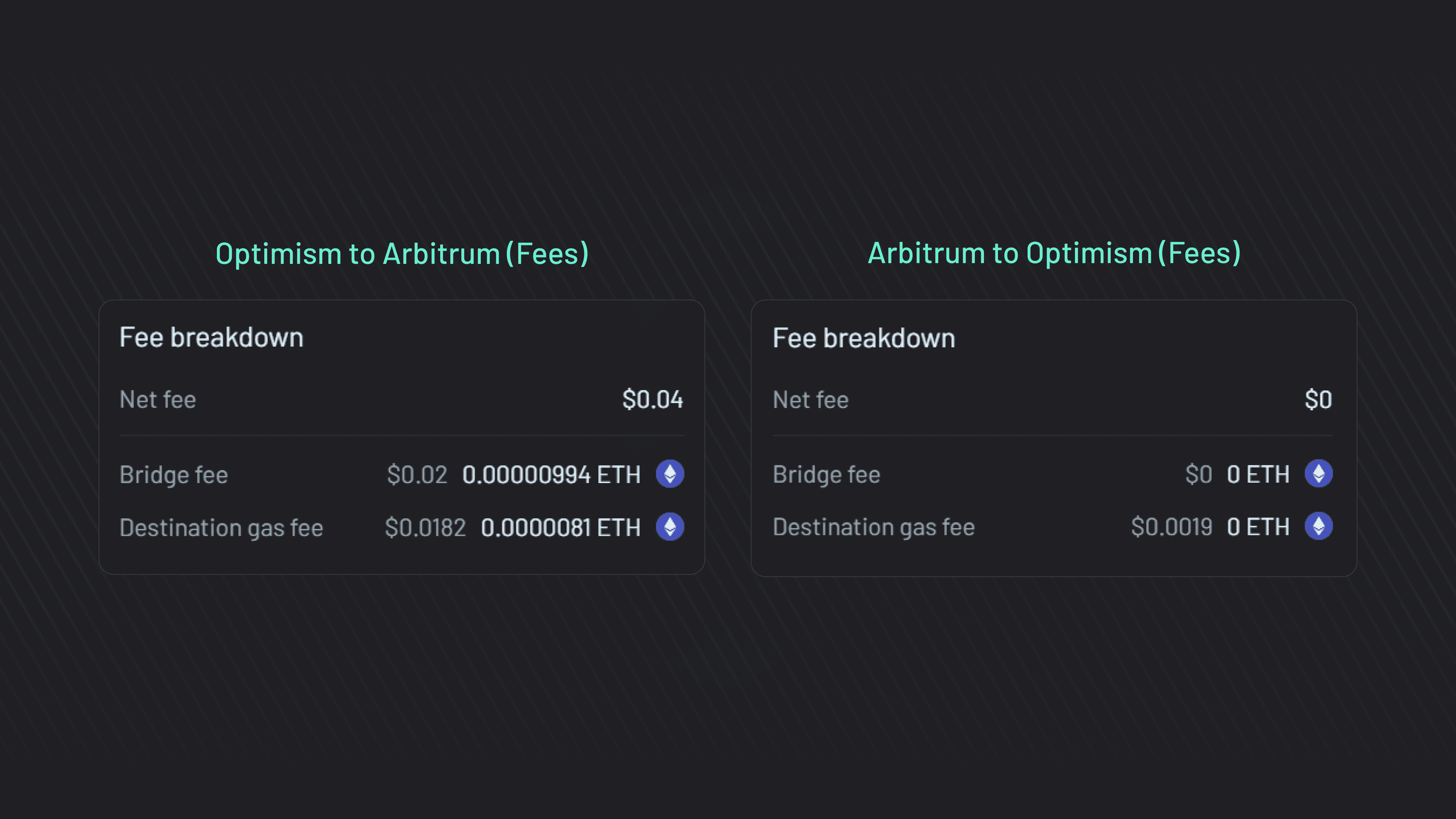

For a deeper dive, be sure to read our full bridging guides for Optimism and Arbitrum to learn how to get the most out of crosschain interoperability. But for a quick start, here’s a look at fees and bridging times between Arbitrum and Optimism on Across:

Fast, Cheap, and Secure Bridging with Across

Across offers a superior solution as the fastest and most cost-effective way to bridge assets between Optimism and Arbitrum. With Across, users benefit from low fees, robust security, and an industry-leading bridging experience with times that average:

L1→L2: 15 seconds.

L2→L1: 10 seconds.

L2→L2: 3 seconds.

Notably, as exhibited above, Across often completes bridging between Optimism and Arbitrum in less than two seconds, compared to 15+ minutes on native bridges and withdrawals that take eight days due to Optimistic Rollup security measures.

The Future of These L2s

As Ethereum Layer 2 solutions evolve, Optimism and Arbitrum are advancing distinct strategies to enhance scalability, interoperability, and decentralization. Notably, as the wider crypto market surfs the changing regulatory tides and broader institutional onboarding, both Optimism and Arbitrum are responding accordingly.

Optimism's Roadmap

Optimism is spearheading the Superchain, a network of OP Chains built on the OP Stack to unify security, governance, and interoperability across multiple L2s. By the end of 2025, Optimism aims to strengthen crosschain communication through a Message Passing Protocol and ERC-7802, a standard designed for seamless token bridging between OP Chains.

Arbitrum's Roadmap

Arbitrum is prioritizing customizability and decentralization, focusing on its Arbitrum Orbit framework, which enables developers to launch custom Layer 3 chains tailored to specific applications.

A key milestone for 2025 is the decentralization of its sequencer, which will distribute the responsibility of transaction ordering across a broader, decentralized network of participants, reducing the risk of censorship attacks and enhancing reliability.

Impact of Ethereum Upgrades

Ethereum’s EIP-4844 upgrade, implemented in March 2024, introduced blob-based data availability and significantly reduced L2 transaction fees. Arbitrum was well-positioned to benefit early thanks to its Nitro upgrade, which had already optimized transaction compression and data handling.

The recent Pectra upgrade, launched in May 2025, further enhances these gains by increasing blob capacity, reducing costs, and improving scalability across L2s. Optimism’s Superchain also benefits from cheaper transactions, but its biggest advantage lies in how EIP-4844 and Pectra improve crosschain communication between OP Chains.

Additionally, Optimism and Arbitrum have been early supporters of ERC-7683: Ethereum’s universal standard for expressing crosschain intents. This standard enhances ecosystem interoperability by providing an open-sourced framework for developers who want to build protocols and applications with crosschain functionality. Now, over 70 projects (and counting!) support ERC-7683.

Both Optimism and Arbitrum will likely continue to play a key role in Ethereum’s long-term scaling roadmap. Optimism’s Superchain continues to enable a network of interconnected chains, improving crosschain user experiences and creating a unified L2 ecosystem, while Arbitrum’s Layer 3 technology promises to allow developers to build custom, high-performance blockchain solutions for DeFi, gaming, and specialized applications.

Optimism vs. Arbitrum: Final Thoughts

As Ethereum’s scaling landscape evolves, Optimism and Arbitrum have emerged as two of the most significant Layer 2 solutions. Both networks provide faster transactions, lower fees, and greater accessibility while leveraging Ethereum’s security with approaches that differ in key ways.

On the one hand, Optimism prioritizes interoperability and ecosystem unification through the Superchain, creating a seamless multichain experience for developers and users alike. Arbitrum, on the other hand, focuses on customizability and performance, giving developers greater flexibility through Layer 3 solutions while maintaining strong DeFi adoption.

Ultimately, choosing the right L2 depends on individual needs, and understanding these differences helps users and developers maximize capital efficiency and leverage the best opportunities across chains. Both Optimism and Arbitrum are making Ethereum faster and cheaper, albeit taking slightly different roads to get there.

Yet, no matter where you trade, stake, or build, you’ll need a reliable way to move assets across chains. That’s where Across comes in: bridging your assets faster, cheaper, and without the headache.

Ready to bridge? Try Across today.